The MPC Wallet That Powers Institutional Trading at Scale

OTC Desks, LPs, Brokers, and Market Makers all rely on Fordefi to automate, protect, and grow their digital-asset operations. Our MPC platform combines programmatic signing, quorum-based governance, exchange connectivity, and full support of 90 + blockchains.

Access Secure Cross-Chain Connectivity

Fordefi enables trading teams to connect to any dApp on any chain enabling them to trade, stake, bridge, and settle across leading blockchains, as well as on CEXs like Binance, Coinbase, OKX, and Bybit—through a single MPC-protected workflow.

- Trade on-chain or move funds to a CEX from the same workspace

Swap on Uniswap, add liquidity on Solana, or top up a Binance spot account without moving through multiple platforms. - Support any EVM project from day 1

We offer self support for any EVM chain with policies and enrichment right out of the box. - Self support for any EVM chain with policies, enrichment right out of the box.

The Wallet API creates, signs, and broadcasts transactions programmatically, while webhooks stream confirmations back to your trading systems.

As a digital asset market maker, we are participating more and more in on-chain protocols both manually and algorithmically. Finding a wallet suitable for these operations was a necessity. The freedom that Fordefi allows for DeFi protocol interaction, as well as limit that freedom based on specific rules, makes it a great tool for rolling out these on-chain activities.

Execute Trades With Enriched Transaction Data

Simulate outcomes, verify counterparties, and catch risk—all before broadcasting a trade.

- Simulate the full balance impact

Preview expected balance changes, slippage, and gas costs so you know the result of every call before it hits the chain. - Verify every contract and counterparty

Fordefi’s DApp Directory resolves contract addresses to recognized protocols and functions, replacing hex strings with names you trust. - Cut exposure with Autorevoke by CARE

Real-time alerts flag untrusted contracts or oversized approvals, and Autorevoke by CARE can automatically strip unwanted allowances once the trade settles.

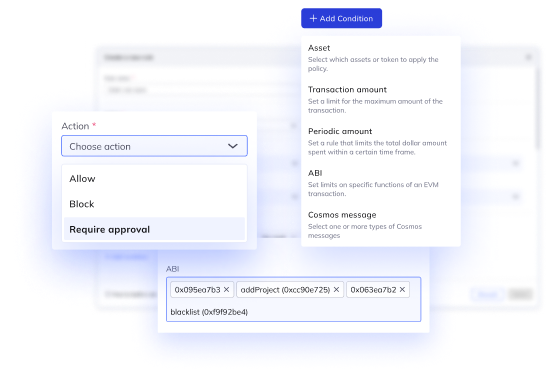

Govern Access and Risk with Granular Controls

Maintain granular governance across every trade with Fordefi’s sophisticated policy engine.

- Establish collaborative workflows for multi-party settlement

Set basic or group-based admin quorums and multisig thresholds so sensitive changes require the right mix of signers. - Assign role-based vault permissions

Grant view, approve, or sign rights per vault so each team member engages only where needed. - Manage limits and allowances in real time

Edit or revoke token allowances, cap notional size, gas, and slippage, and apply MEV-mitigation rules before a trade is signed.